Can i borrow 5 times my salary for a mortgage

Additionally in Sweden there is something called a skuldkvot or debt quota meaning if the amount youre loaning is more than 45 times your yearly salary or the yearly salary of you and your co-applicant if youre applying with someone else you need to amortise an additional 1 percent per year on top of anything you have to. The Great Recession was a period of marked general decline ie.

How To Increase The Amount You Can Borrow My Simple Mortgage

Best of both worlds.

. If I received 31800 can I borrow from that money and later replace it. If you choose to use lenders mortgage insurance to increase your borrowing power you can choose to add it to the loan balance though keep in mind this means youll pay interest on it. The closing costs were 25 higher than before.

My Money Sorted is a digital finance platform for expert money tips tailored insights and helpful tools to get your money sorted. What happens to my mortgage when I sell my home. But to compensate for the low downpayment FHA loans require a mortgage insurance premium.

The house must also be bought from a builder recognized by the program. Borrow nearly 5 times your salary with a small down payment Value of the home you can afford 532000 Monthly payment for mortgage principal and interest 2700. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

In the majority of cases unless you are porting it the mortgage on your existing home is redeemed paid off when you sell. For the first 10 years of a 30-year mortgage you could be paying almost solely on the interest and hardly making a dent in the principal on your loan. According to Fannie Mae factors that go into approving a mortgage for a self-employed borrower include the stability of the borrowers income the location and nature of the borrowers.

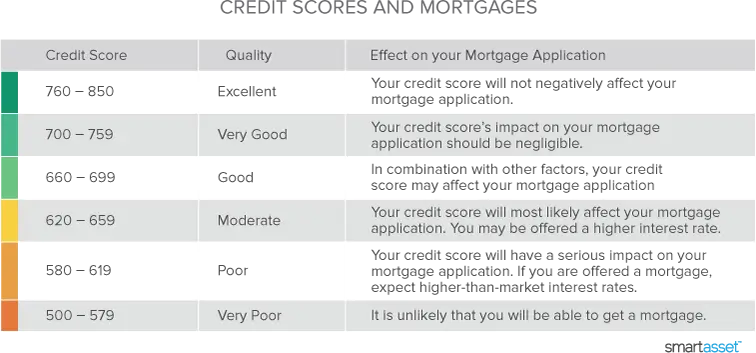

This option is appropriate for first-time homebuyers with less than perfect credit scores. A typical homeowner with a 400000 mortgage on a tracker rate will see their monthly payments jump by 99 or 1188 a year. Even though income hasnt been the key lending criteria for banks.

However regulatory restrictions limit banks to having no more than 15 of their mortgage loans above the 45x multiple. Borrow from her 401k at an interest rate of 4. In rare cases lenders may loan up to 5 times the borrowers annual salary.

Now I have 85 equity in my home and do not need a new mortgage. Find out what you can borrow. Refinance my Mortgage Use our Mortgage Money Calculators Estimate the cost of Stamp Duty.

As you can see rates fall at 3000 5000 and 7500. In the case of a 30-year mortgage depending of course on the interest rate the loans interest can add up to three or four times the listed price of the house yes you read that right. Borrow up to 6 times your salary criteria apply 95 Loan to Value LTV available Make additional payments and overpayments subject to your mortgage terms Borrow for up to a 35 year term with a capital repayment mortgage.

I mean what if I have an outstanding payment to make can I take 10 000 and but it back without any penalty. I can pay off the existing mortgage by writing a check at any time. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

Or 4 times your joint income if youre applying for a mortgage. At the time the International Monetary Fund IMF concluded that it was the most severe economic and financial meltdown since the Great. This is the underlying point there are two cliff-edges where the interest rate drops with the descent at 5000 particularly steep.

Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate. If you can clear these within the 0 period they may be cheaper. Lenders mortgage insurance is an insurance cover that protects a lender if you cant meet required mortgage repayments and default on your loan.

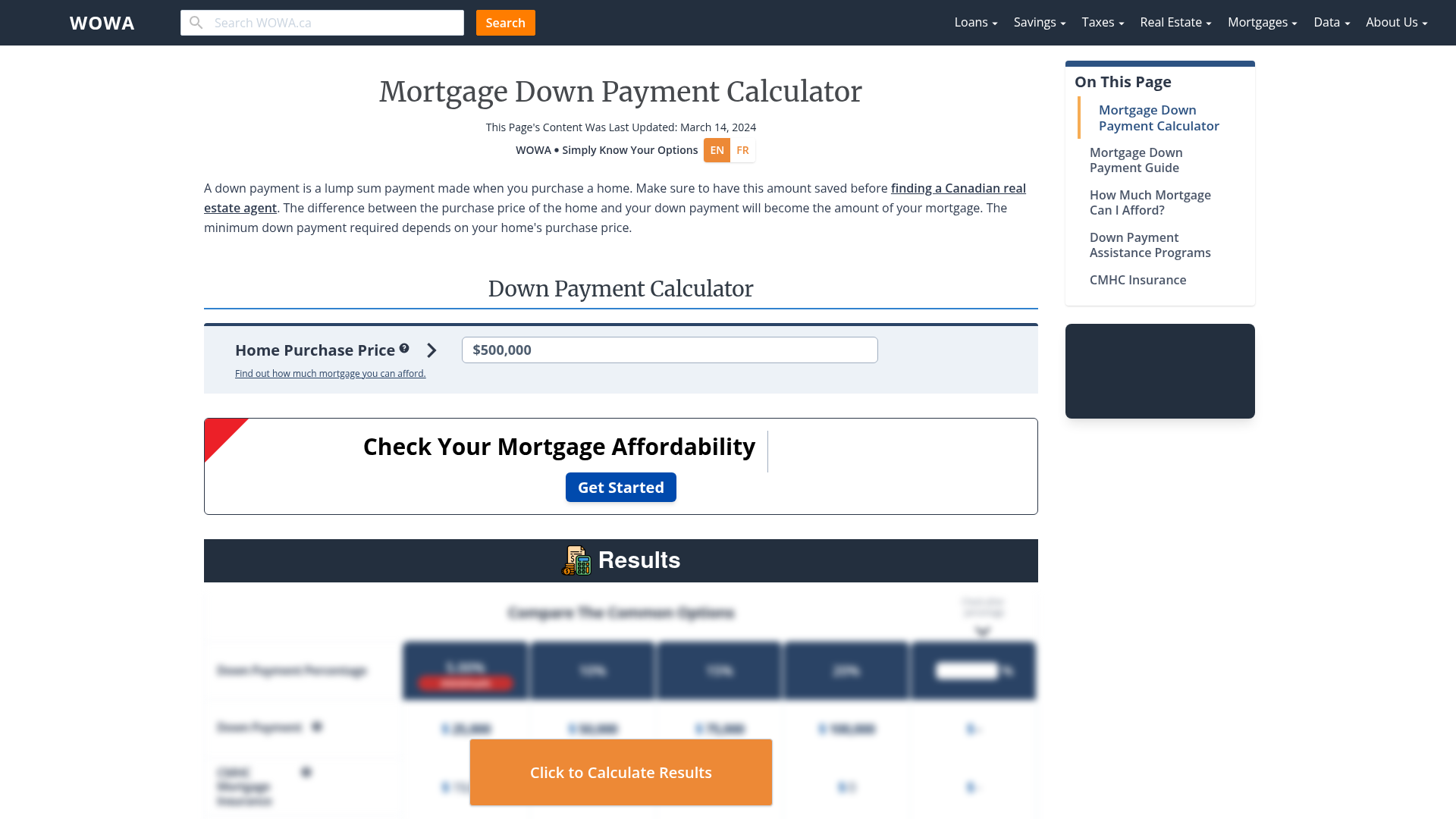

And if so can I start. The usual rule of thumb is that you can afford a mortgage two to 25 times your income. As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75 of the loan.

Base pay salary or hourly. The equity loan scheme finances the purchase of newly built houses. The solicitor or licensed conveyancer handling your paperwork will contact your lender for a redemption statement and repay the outstanding loan amount to them out of your.

Get a mortgage with a minimum 5 deposit. Based on my salary from last year but can I use the EIDL funds to pay a newly hired employee. How much can I borrow.

Can an EIDL Cover My RentMortgage. I was irritated and have not investigated an RM again. At 60000 thats a 120000 to 150000 mortgage.

Your loan officer can advise you on conventional loan income. The Australian Government also puts money into your super at times. You can qualify for an FHA loan if you can make a small downpayment 35 percent of the homes value.

You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. A recession observed in national economies globally that occurred between 2007 and 2009The scale and timing of the recession varied from country to country see map. 55x your salary if you earn 75K or 100K on a joint application if youve got a 15 deposit to borrow up to 2M How many times my salary can I borrow The idea that mortgage lenders use a secret salary-multiplier formula is that UK borrowers are reluctant to let go.

Max loan size 500000. How much is my mortgage going up by. In these cases lenders can be selective and only choose borrowers with low debt loads that can afford a substantial deposit.

Borrow from the bank at a real interest rate of. FHA mortgages usually come in 15 and 30-year fixed rate terms. By paying off your mortgage early you could use the money you save each month.

Working out whether to invest or pay off your mortgage doesnt have to be an eitheror choice. Fannie Mae guidelines allow the following types of income to qualify for a mortgage. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

I got a quote and I was surprised but it wasnt pleasant. How Much Mortgage Can I Afford if My Income Is 60000.

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

I Failed To Get A Mortgage Because Of My Pension Contributions Mortgages The Guardian

Can I Get A 5x Mortgage In 2022 Boon Brokers

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Mortgage Can I Get Mortgage Guides Yescando Money

How Much Mortgage Can I Afford Smartasset Com

Learn How To Borrow Money In Times Of Need With This Guide Forbes Advisor

How To Increase The Amount You Can Borrow My Simple Mortgage

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

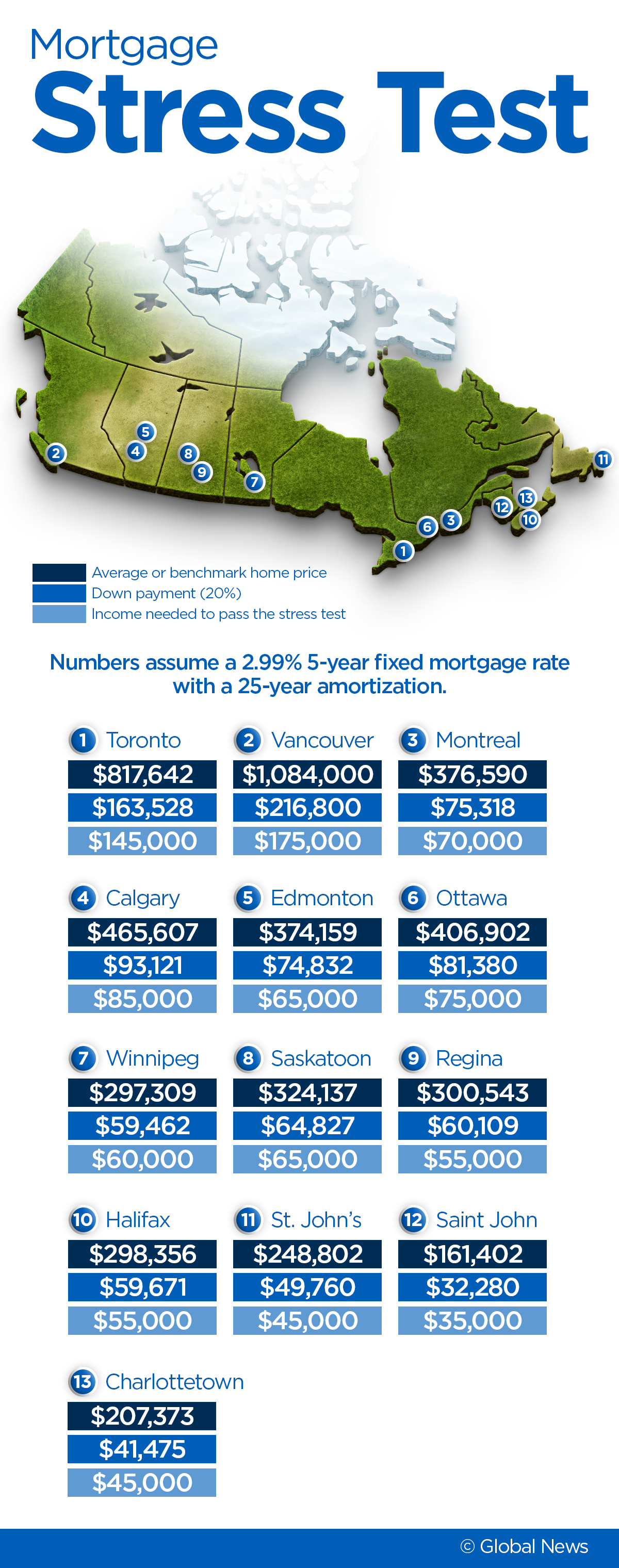

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

As A First Time Home Buyer How Much Can I Borrow Wmc

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca